Business plan

Conceptual

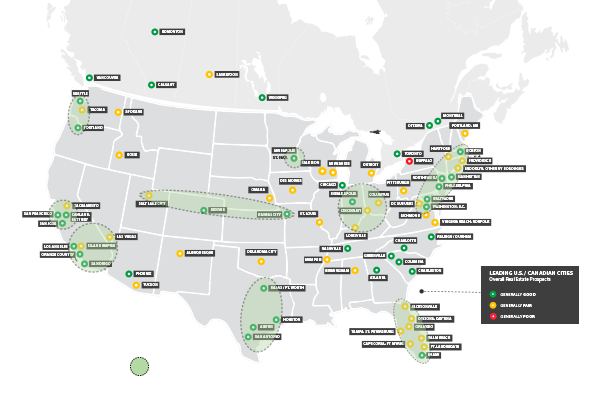

Real estate investments in the United States of America.

A strategic partnership aimed at "Industrial Properties in the United States of America" that offer the opportunity for capital preservation and long-term appreciation.

EXPANDING HORIZONS

NORTHBOUND

Capturing value in a historic cycle of the industrial real estate sector in the United States of America.

TANGIBLE BENEFITS FOR PANORAMA'S CURRENT BUSINESS TO ENTER THE US MARKET UNDER THE PANORAMA USA BRAND.

Investment Group

- Diversification of the current portfolio with potential for attractive risk-adjusted returns

The business

- Capitalizing on a historic opportunity cycle

- Recent market dynamics >> impossible to ignore

The tenants

- Capitalizing on a historic opportunity cycle

- Deepening relationships with industrial tenants in North America as trade consolidates in the region

- Offering real estate solutions to clients in multiple locations

TARGET STRATEGY

Investments that preserve wealth, generate income, and growth.